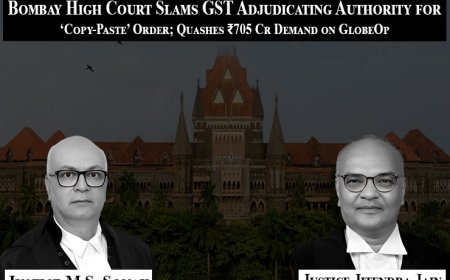

Bombay High Court Slams GST Adjudicating Authority for ‘Copy-Paste’ Order; Quashes ₹705 Cr Demand on GlobeOp

Mumbai — In a significant ruling reinforcing the sanctity of natural justice, the Bombay High Court has quashed a massive GST demand order of ₹705.79 crores issued against GlobeOp Financial Services (India) Pvt. Ltd., observing that the adjudicating authority had failed to apply its mind and had merely reproduced the show cause notice verbatim in its final order.

A Division Bench comprising Justice M.S. Sonak and Justice Jitendra Jain in Writ Petition (L) No. 12528 of 2025 came down heavily on the Deputy Commissioner of State Tax, holding that such a "cut and paste" approach not only undermines procedural fairness but also renders the decision-making process legally untenable. “The adjudicating authority has failed to independently apply its mind… Instead, it has chosen to copy or rather cut and paste verbatim the allegations in the show cause notice to pass them off as reasons,” the Court noted, underscoring a blatant breach of Sections 73(9) and 75(6) of the CGST Act, 2017.

Despite arguments from the State that the petitioner should have availed the alternative appellate remedy, the Court ruled that the case was a textbook example of the exception—i.e., a violation of the principles of natural justice warranting direct intervention.

The petitioner, represented by Senior Advocate Rohan Shah, had demonstrated via a comparative chart that the impugned order dated 24 February 2025 mirrored the show cause notice issued on 28 November 2024 without addressing specific rebuttals, judicial precedents, or the relevant CBIC Circular dated 20 September 2021.

Citing precedents such as Piramal Enterprises Ltd. v. State of Maharashtra and Union of India v. Tulsiram Patel, the Court observed that merely reproducing replies or notices without reflective reasoning does not amount to due consideration under the law.

Ultimately, the Court quashed the impugned order and remanded the matter back for fresh adjudication within three months, emphasizing that the taxpayer must be afforded a full and fair hearing.

The judgment serves as a stern reminder to tax authorities that decisions must be reasoned, reflective, and not mechanical reproductions—especially when stakes run into hundreds of crores.

What's Your Reaction?